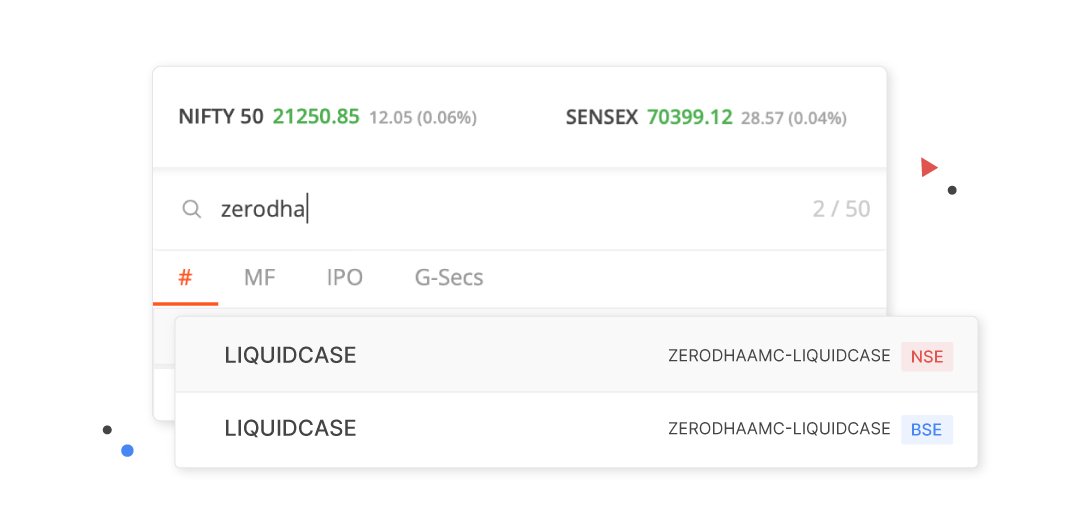

Zerodha AMC (Asset Management Company), a pioneering fintech firm spearheaded by Zerodha and Amazon backed Smallcase, recently unveiled LIQUIDCASE – an innovative growth equity traded fund (ETF) designed to simplify the investment experience for its valued clients. With this launch, investors can now say goodbye to dividend complications and tax-related nuances that often cloud their financial journey.

In a recent post on X, announcing the new offering, Nithin Kamath, CEO of parent company Zerodha, expressed his enthusiasm: “When we were thinking about the product, we wanted to offer something simple where investors didn’t have to bother about dividends, taxes, etc.” LIQUIDCASE represents this very philosophy in action.

So how does it work? In essence, the ETF’s total corpus (or net asset value) absorbs any income generated from dividends instead of being distributed as payouts to investors. This process closely mirrors that of growth mutual funds; returns are added directly to the NAV without issuing interim dividend payments or dealing with fractional units and tax complications.

The ETF’s net asset value (NAV) is determined by the per-share worth of its owned assets, which fluctuates based on market conditions – increasing as asset values rise while decreasing when they decline. LIQUIDCASE tracks the Nifty 1D Rate Index, an important benchmark that measures returns from overnight lending transactions in India’s financial markets.

Kamath explained: “The ETF tracks the Nifty 1D Rate Index, and its return profile will be similar to that of overnight mutual funds. So, better than most savings bank account interest rates. So, the way LIQUIDCASE works is simple: the returns in the ETF will be added to the NAV just like growth mutual funds, and there will be no dividends. This makes it easier for you to track your returns, and there are no hassles with fractional units and figuring out your taxes.” This unique blend of transparency, simplicity, and attractive yields positions LIQUIDCASE as an enticing option for investors looking to optimize their portfolios.

Zerodha Fund House was established in April 2021 through a strategic partnership between Zerodha and Amazon-backed smallcase, marking the beginning of this groundbreaking journey. Since its launch in late October of that year, it has amassed impressive assets under management totaling Rs 240 crore within just two months.